Real Estate Guides

Helpful Guides - At Your Fingertips

- First-Time Buyers Guide

- Moving & Relocation

- Home Financing Guide

- School Reports

- Neighborhood Reports

- Home Selling Guide

- Home Prep And Staging Guide

- Home Sale Marketing Guide

Short Sales have been a large part of the Denver housing market in recent years. With rising home values, however, we are seeing fewer and fewer of them.

A short sale is a voluntary process that occurs when the bank or lender agrees to allow the homeowner sell the property for less than what is owed on the mortgage loan.

A "foreclosure" is different in that it's a legal process where the homeowner forfeits their rights to the property.

Even though prices have been on the climb, some homeowners still owe more against their loans than the property is worth. If you owe more than your home is worth, a short sale may allow you to avoid foreclosure. Many mortgage lenders still agree to participate in a short sale, because they can avoid the legal expenses and hassles of foreclosure.

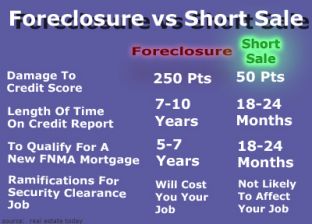

With both a short sale or foreclosure, the homeowner ultimately loses their home or property. In the case of a short sale, however, the financial hardship may be less severe. A short sale has an adverse impact on one's credit score, but in the case of foreclosure, that impact is far more painful. Just review the chart below, that compares the probable outcome on your credit between the two alternatives.

One benefit to a successful short sale is that some homeowners are now eligible to obtain a new mortgage loan for the purchase of a replacement house. That is not possible with a foreclosure. The typical wait period is a minimum of 3 to 7 years.

● Homeowner owes $200,000 on their mortgage, but the fair market value is less.

● Homeowner puts house on the market as a Short Sale.

● Buyer agrees to pay fair market value for home - $175,000.

● Mortgage lender agrees to accept the $175,000 as full payoff of the mortgage.

● House sale closes.

● Homeowner owes no additional mortgage debt and avoids foreclosure.

Many uncontrollable events happen in life that lead to a short sale or foreclosure. Unexpected illnesses, divorce, job relocation, active military duty, unemployment, local economic conditions, excessive debt, financial insolvency, a death in the family, or any combination of these events.

Another common reason for homeowners to seek short sale assistance is related to the financial and credit market collapse several years ago. The resulting decline in property values during that collapse, resulted in many mortgage loans exceeding the current value of the real estate. Given this, it wasn't possible for the homeowner to sell and move, without bringing a sack of money to the closing table. That is why some homeowners still seek short sale assistance from their mortgage lender, if they can no longer make the payments.

Homeowners facing economic hardships may have a foreclosure looming, but are often too proud or uninformed to do anything about it, until its too late. Before considering bankruptcy or allowing the bank to foreclose, consider a short sale. Although there is no guarantee your lender will agree to a short sale, here is a list of the benefits of participating in a short sale, versus being foreclosed upon.

If you think you'd benefit from selling your house as a short sale, but you're behind on your mortgage payments or you have little or no equity, we should schedule an appointment to explore the options. I look forward to working with you to help prevent a foreclosure. I'll communicate with your lender to determine if you qualify for a short sale. If you do, we'll market your home for a realistic sales price in order to get the house sold prior to foreclosure. We manage the entire process, so you can concentrate on other things and get your life and finances back on track.

NOTE: If a foreclosure is already in process, I and my team may be able to persuade your lender to grant an extension of the foreclosure sale date.

Our short sale appointments are the quickest way to answer your questions, and help you understand the best options. Sometimes its difficult to seek professional advice, buy you'll be glad you did. CALL TODAY. Consultations are FREE - (303) 514-4000.

**Congress enacted H.R. 3648, "Mortgage Forgiveness Debt Relief Act of 2007." This legislation discharged mortgage tax indebtedness after January 1, 2007. Federal Bailout Legislation H.R. 1424, extends the relief through December 31, 2012. Colorado state law also also restricts the lender from pursuing deficiencies in some circumstances. Also see Definition of Short Sale.

Michael Dagner is an expert in Denver-Area home sales.

Call today, (303) 514-4000, for help with your home sale or purchase.

RELATED ARTICLES

by Michael Dagner: Google+

The Michael Dagner Group, Brokers Guild Cherry Creek Ltd, 7995 E. Hampden Ave, Ste 100, Denver, CO 80231 Map

5 Minutes From The Denver Tech Center - Near Tamarac Square, 9-Mile Station, & Cherry Creek Reservoir

(303) 514-4000

Copyright © 2010-2011, the Michael Dagner Group. All rights reserved. Sitemap | Terms Of Use | Our Commitment To Your Privacy